Financial Assertion Vs Statement Of Economic Position What’s The Difference?

Not getting the timing proper on monetary statements, particularly stability sheets, can cause big errors. A balance sheet exhibits a company’s monetary situation on the finish of a interval. If that is ignored, it might possibly lead to incorrect conclusions and decisions. Financial statements and statements of financial position are two essential documents that present priceless details about an organization’s monetary well being. Whereas they both serve the same objective of reporting financial data, there are key variations between the two which may be necessary to grasp.

The statement of economic position solely data the corporate account data on the final day of an accounting period. Some company’s financial statements might not feature a separate statement of retained earnings. As A Substitute, this information is included or supplied as an addendum to either the income assertion or stability sheet. The statement of economic position provides the information needed to carry out fundamental evaluation and achieve perception into a company’s financial stability. By utilizing the figures for assets, liabilities, and equity, one can calculate various monetary ratios to evaluate https://www.kelleysbookkeeping.com/ different elements of the business.

You Are Presently Viewing Our locale Web Site

In this article, we are going to outline what a statement of monetary place is, the means to make the stability sheet, in addition to another name for a statement of financial position is a the disadvantages and benefits to both profit and non-profit organisations. When making a balance sheet, avoid misclassifying property and liabilities. Guaranteeing accuracy and adhering to standards exhibits true financial status.

Terminology And Nomenclature

Its cash move assertion shows a internet cash improve of ₹50 lakh, confirming adequate liquidity for operations. Why It’s UsefulThe money flow statement is important for making certain an organization has enough liquidity to pay bills, spend cash on development, or repay debts. What It ShowsThe cash flow statement tracks the motion of cash in and out of an organization over a interval, specializing in liquidity somewhat than profitability.

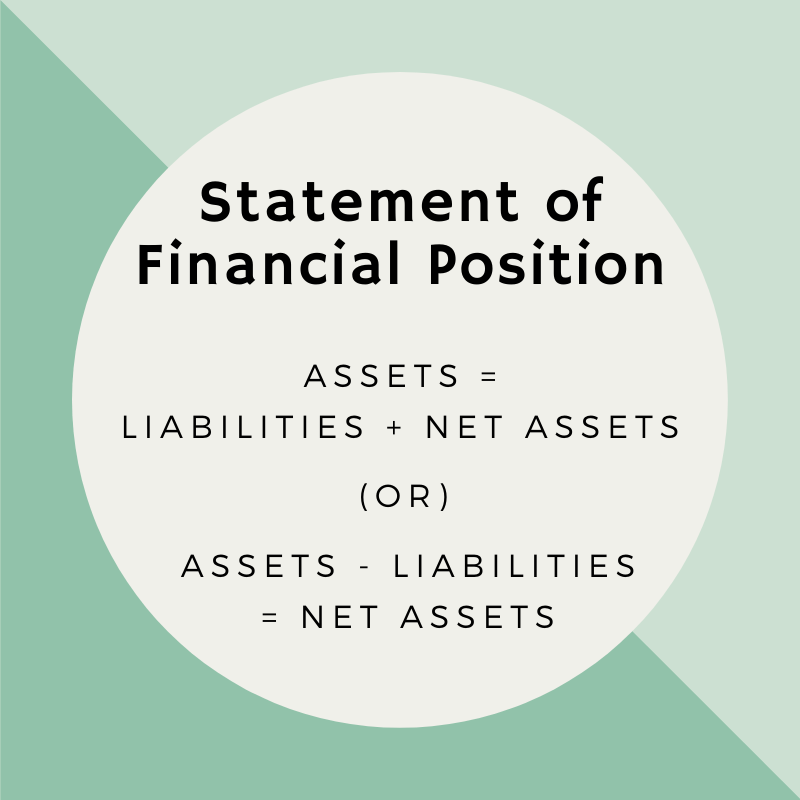

They are often offered in a structured manner that enables for easy comparability between different intervals or firms. In distinction, the statement of financial position is presented in a selected format that reveals the corporate’s property on one side and its liabilities and equity on the other facet. The information on the statement of economic position can be utilized for a variety of monetary analyses, such as comparing debt to fairness or comparing current assets to current liabilities. Or, info on the steadiness sheet may be compared to data on the income statement, corresponding to a comparison of sales to whole assets. These analyses are typically offered on a pattern line, so that you just can detect any adjustments within the financial position of the reporting entity over time. The function of the assertion of economic position is to supply a snapshot of a company’s monetary condition at a selected point in time.

Why Is The Balance Sheet A Crucial Decision-making Tool For Stakeholders?

- For BeginnersUnderstanding the cash circulate statement might help you assess a company’s ability to manage cash, a key talent for finance roles or running a enterprise.

- Stakeholders use this to make sensible investment and technique choices.

- It is important for being open and constructing belief with these involved.

- This ensures monetary reviews are clear, thorough, and proper.

- The assertion of monetary position is ready by nearly all businesses that utilize a double-entry accounting system.

Be Taught extra in regards to the standards we comply with in producing Accurate, Unbiased and Researched Content Material in our editorial policy. Lastly, the company may take out a loan to purchase an asset. Fairness refers to the worth of a company that belongs to its owners. One of the necessary thing variations between the Stability Sheet and Statement of Monetary Position lies within the terminology and nomenclature used. The Balance Sheet is a term generally used in the Usa and other nations following Generally Accepted Accounting Principles (GAAP).

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, supervisor, consultant, college teacher, and innovator in teaching accounting online. Those decreases imply that at the finish of Year 1, the business has a negative cash position of $20,000, that means the business cash has been overdrawn. The classification ought to be further to better replicate the essence of the transaction, primarily based on crucial economic exercise of the company.

How Does The Steadiness Sheet Influence Business Valuation?

While they may differ in terminology, format, and regulatory framework, their underlying ideas and attributes stay consistent. Both statements are important tools for financial analysis and decision-making, allowing stakeholders to assess the financial health and stability of a company. It aids financial evaluation by evaluating ratios similar to the current ratio, which demonstrates whether short-term property are sufficient to cowl short-term obligations. The financial place statement, also referred to as the stability sheet, provides an in depth have a look at an organization’s funds at a sure time. It Is key for checking the monetary health and the way nicely a business can operate.

The first one is Accounting Requirements for Non-public Enterprises (ASPE), which she says is utilized by the vast majority of BDC shoppers. The second one is the International Financial Reporting Standards (IFRS), utilized by bigger businesses that may be interested in moving into international markets. In this state relate the online results of the change administration in the financial construction and all cl mirror the increase or lower in cash and short-term investments in the course of the interval. To address your query, QuickBooks customizes a lot of its features based mostly on the kind of group you select during the setup course of.

Studying the types of financial statements is much less complicated with professional steerage. Starting with a single assertion, like the revenue assertion, can build your confidence earlier than tackling extra complicated ones just like the cash circulate statement. You don’t must be from a finance background to know monetary statements. Anybody can be taught the basics with the best coaching and support. Notably, the statement of financial place, or as it’s also known, the balance sheet, will all the time steadiness.